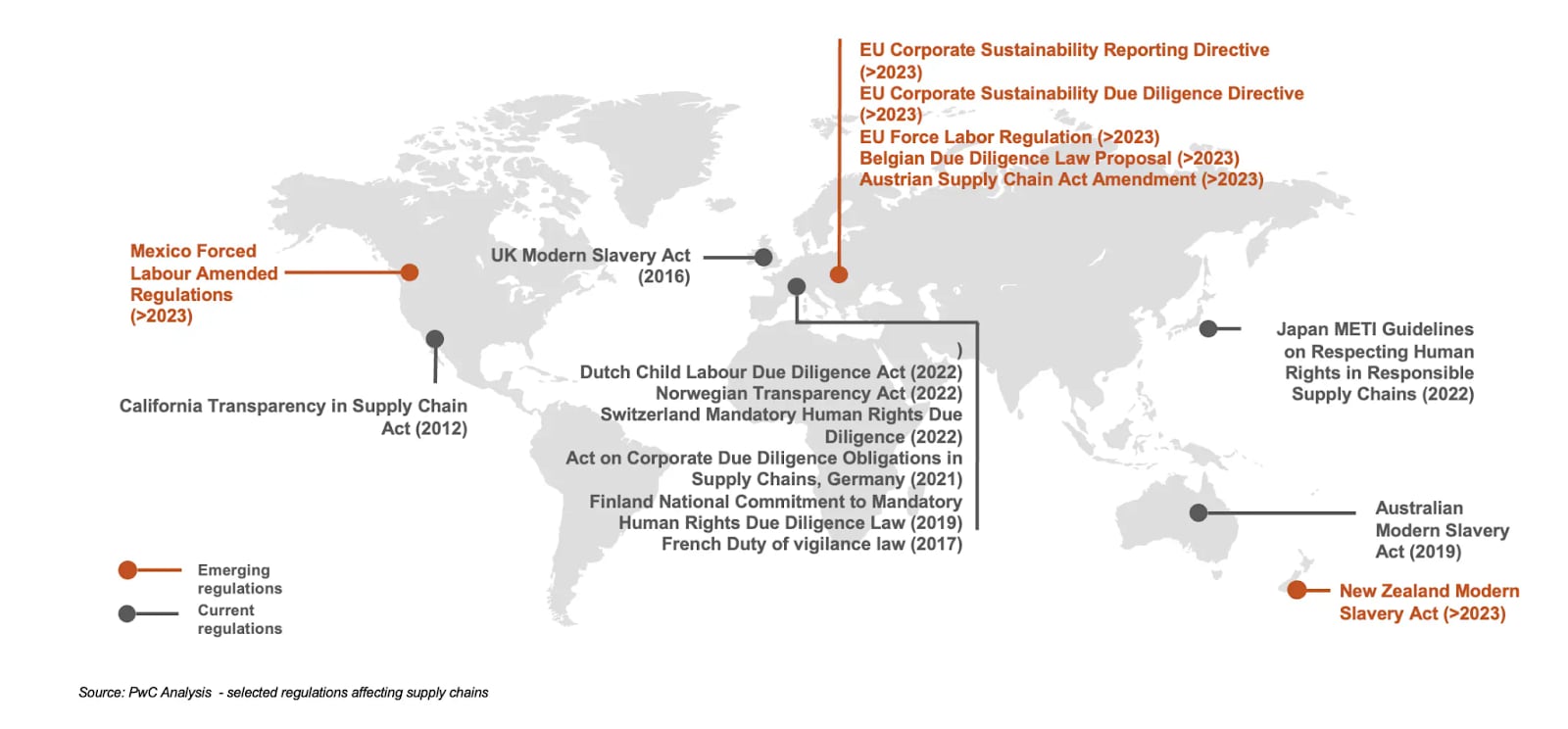

Effective implementation of such rules and regulation requires a multidisciplinary approach — involving legal, compliance,risk, finance, reporting, tax and sustainability departments. This places additional pressure on companies still acquiring the ESG capabilities to ensure they meet the requirements of their stakeholders (including regulators), clients and investors.

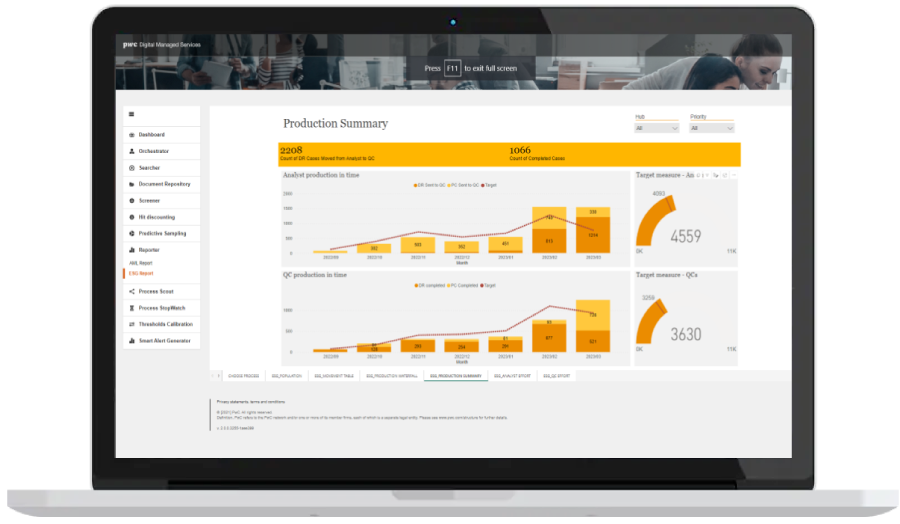

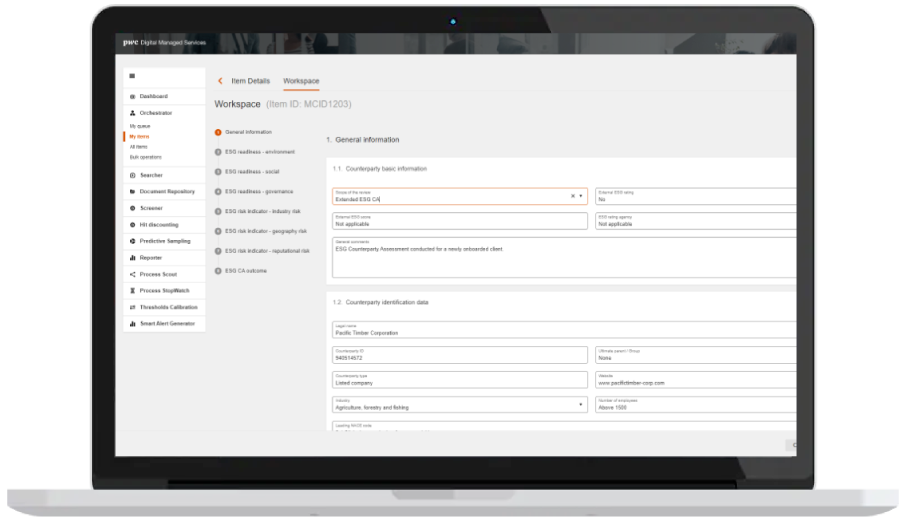

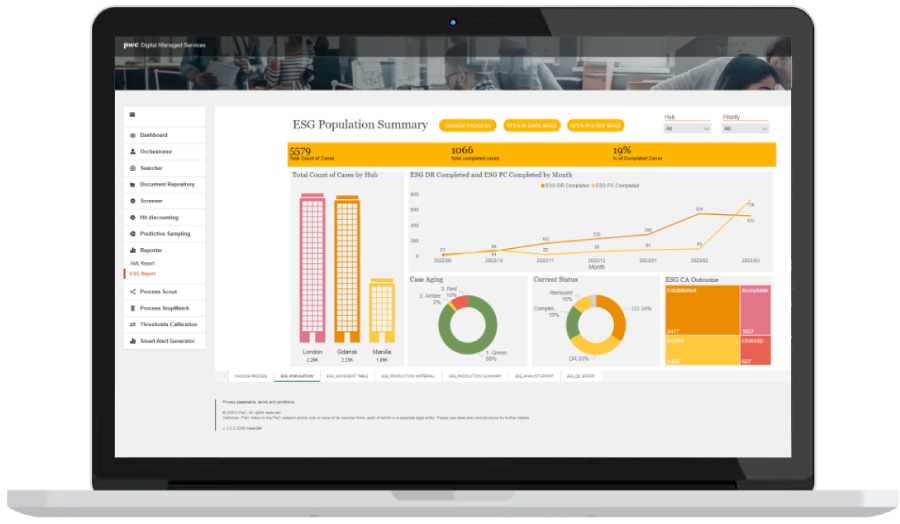

Additionally, conventional approaches to data collection, analysis and reporting are often manual, subject to errors/inefficiencies and require significant time and resources. These often are insufficient to capture third party data required for effective reporting and/or supply chain risk management. Organisations with thousands, or in tens of thousands of counterparties will simply not find conventional approaches scalable or cost-efficient.